Timing the market, is it really possible?

Many people say timing the market is impossible, and to an extent they would be right. This is why the idea that minimum 95% of day traders lose money is true , since calling the precise entry for futures trading is absolutely necessary to get right because you can't hold a losing position for years like you can with this strategy using "spot trading" which is what Im suggesting here (not financial advice). With what I'm showing you here is more forgiving since it is a long term investing strategy (2-4 years typically) BUT does require a lot of patience until the right buy "zones" and sell "zones" present themselves for your long term investment. Remember the age old saying "Buying low, sell high"? Well I found a free indicator that has accurately predicted these buy/sell zones since 2010 for Bitcoin.

Using this strategy I believe it is much better than what many new Crypto investors do which is just buy when there is lot of hype (bull markets) and watch their investments tank after a year (bear market), since they bought at what you'd realize is near a "sell zone" on this indicator which could have guided you to sell not buy.

The strategy presented here is to buy Bitcoin or alt -coins in these "Buy zones" and sell 50% at the "sell zones".

Using this strategy I believe it is much better than what many new Crypto investors do which is just buy when there is lot of hype (bull markets) and watch their investments tank after a year (bear market), since they bought at what you'd realize is near a "sell zone" on this indicator which could have guided you to sell not buy.

The strategy presented here is to buy Bitcoin or alt -coins in these "Buy zones" and sell 50% at the "sell zones".

So what is this magical free tool you're talking about?

The tool I'm talking about is the CVDD/ Terminal Price indicator.

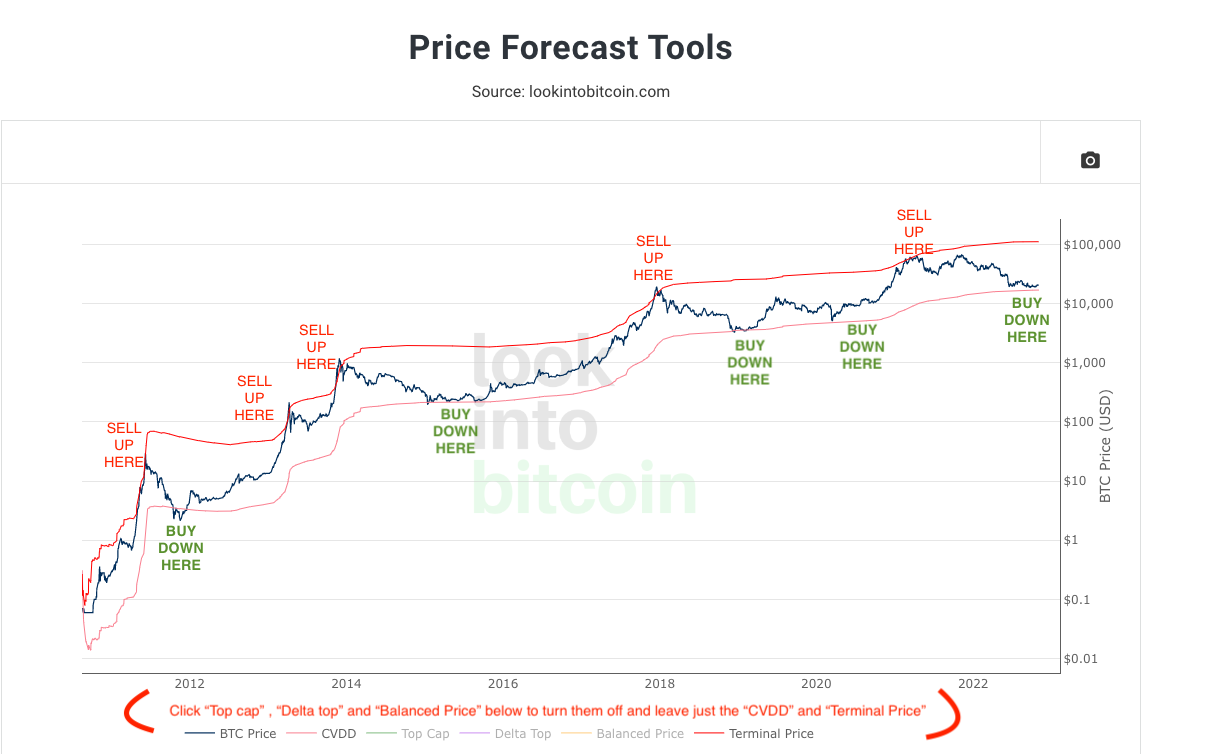

Found below is a photo of the indicator and shows how well it called the top and bottoms. Notice the red text at the bottom that mentions to click "top cap, delta top, and balanced price" to turn it off and only show the CVDD and Terminal price.

So the strategy is to wait until price touches the CVDD area and start dollar cost averaging into the market over 6 months to a year or how you see appropriate.

Then when price starts entering the "terminal price" area (the red line at the top), you start selling 15% chunks until you've sold at least 50% of your portfolio before waiting until a bear market comes and the CVDD area tells you its okay to buy again. If you look at the time stamps on the chart, you realize this can take years of a process and requires tremendous patience and discipline to execute correctly as many new investors suffer from FOMO (fear of missing out) instead of waiting months to a couple years for a great entry for their spot trading.

Even though this strategy has been very accurate in history; history does not guarantee this strategy will work in future. It is a guide to improve beginners decision, but you are 100% responsible for the financial outcome of using this information.

Then when price starts entering the "terminal price" area (the red line at the top), you start selling 15% chunks until you've sold at least 50% of your portfolio before waiting until a bear market comes and the CVDD area tells you its okay to buy again. If you look at the time stamps on the chart, you realize this can take years of a process and requires tremendous patience and discipline to execute correctly as many new investors suffer from FOMO (fear of missing out) instead of waiting months to a couple years for a great entry for their spot trading.

Even though this strategy has been very accurate in history; history does not guarantee this strategy will work in future. It is a guide to improve beginners decision, but you are 100% responsible for the financial outcome of using this information.

So how do I remember when to buy/sell?

Essentially, if you believe in Bitcoin and Ethereum and want to invest for the long term, what you do is look at the CVDD line price in the future and set price alerts for the CVDD line and terminal price area using your favourite charting platform such as Coingecko, Coinmarketcap, Tradingview; then when price hits that area you are alerted to check the charting tool again and start your accumulation. I personally like Tradingview, as I am more involved as an active trader than the average HODL'er.

But this is just for Bitcoin, when I should buy my favourite alt-coin?

Well as Bitcoin is kind of the sun in the Crypto ecosystem, meaning when it's summer for Bitcoin it tends to be summer for alt-coins and when it's winter for Bitcoin, it tends to be even colder winter for alt-coins. It can help guide your decision for when to buy your favorite alt-coins for the long term. (Remember many alt-coins won't be around for years to come, so be careful which ones you choose. Research them to decide their future potential. Just because people rave about it on social media, doesn't mean it will last, there's always risk in investing in Crypto, especially Alt-coins.